No changes to increase in superannuation guarantee percentage

Despite increasing pressure from some businesses and the media to again pause the superannuation guarantee (SG) rate, no changes were announced to the SG rate in the Budget. Consequently, from 1 July 2021, the prescribed SG rate will increase to ten per cent (from the current rate of 9.5 per cent).

This increase will require employers to contribute an additional half per cent to meet their SG obligations for the financial year ended 30 June 2022. Whether this constitutes an additional employer funding requirement or is funded from existing remuneration costs will depend on whether employers operate a ‘salary plus superannuation’ arrangement (incremental additional superannuation cost) or a ‘total employment cost’ arrangement (funds the superannuation increment by way of a reduction to existing salary entitlements).

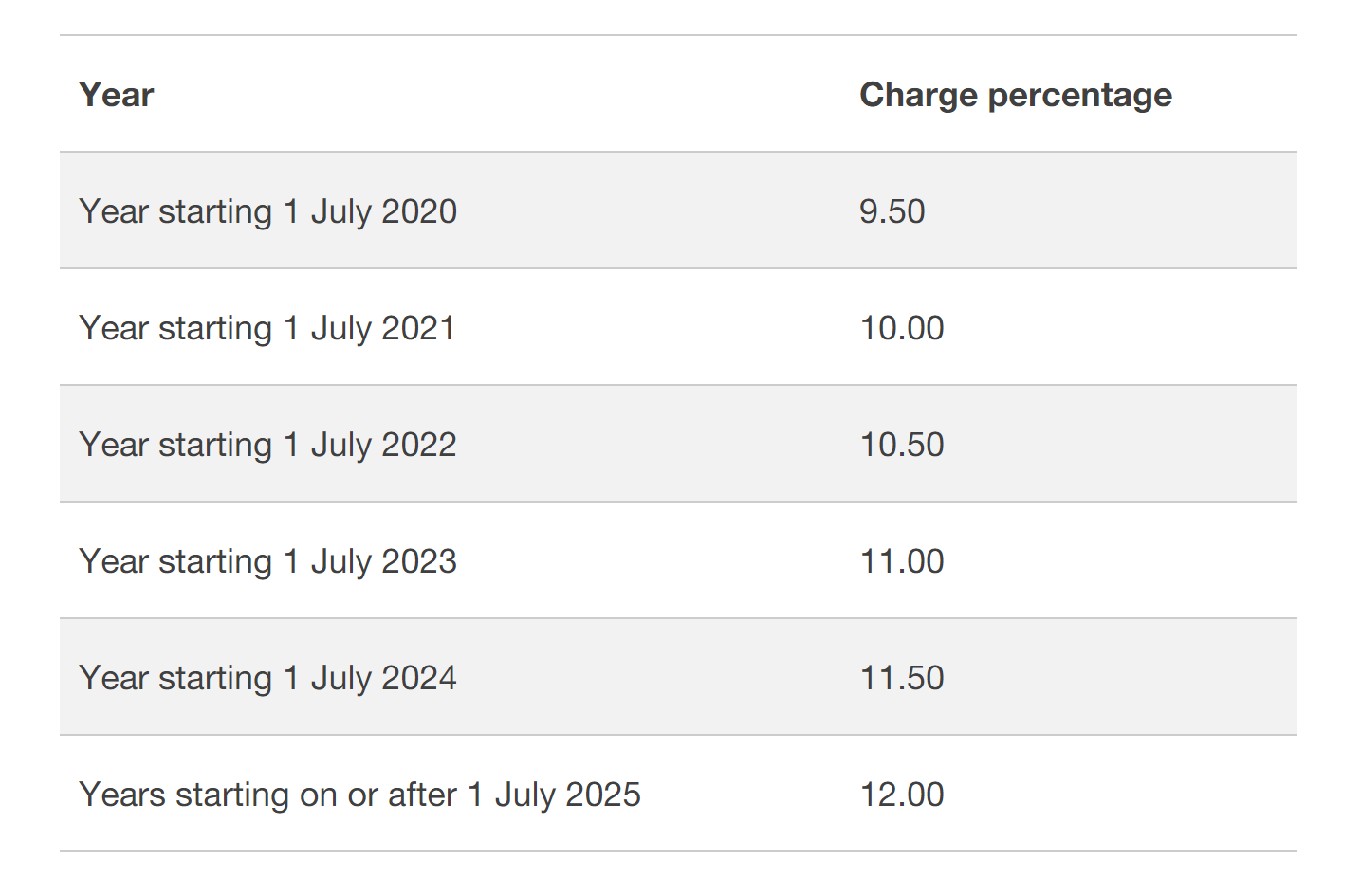

The minimum SG rate is currently legislated to gradually rise to 12 per cent over the next five years as set out in the table below:

Expanding access to superannuation downsizer scheme

Since 1 July 2018, the Government’s superannuation “downsizer” measures have allowed an individual aged 65 years or over to make a non-concessional contribution of up to $300,000 from the proceeds of selling their principal residence owned for the past 10 or more years. These contributions are in addition to those currently permitted under existing rules and caps.

Under the proposed changes, the eligibility age will be lowered to the pre-retirement age of 60 and above. Other rules governing the scheme will remain unchanged. This includes the house having to be owned for at least 10 years. It is understood that since 1 July 2018, about 22,000 people have used the scheme, of which around 55 per cent were women.

This measure will apply from the start of the first financial year after Royal Assent of the enabling legislation (expected to be 1 July 2022).

Retirees able to contribute more to super

The 2021-22 Budget announces changes that will allow retirees to be able to make more contributions to their superannuation by abolishing the work test that applies to certain contributions from the start of the financial year after Royal Assent of the enabling legislation (expected to be 1 July 2022). These changes are intended to remove the complexities that have limited the ability of retirees to top up their superannuation and acted as a disincentive to pursue flexible work.

Currently, the superannuation law prevents super contributions being able to be made by individuals who are 67 years or older unless they meet a work test or work test exemption (subject to limited exemptions). The work test requires a person to be gainfully employed for at least 40 hours in a consecutive 30-day period during the financial year before concessional or non-concessional contributions can be made.

Under the proposed changes, retirees aged between 67 and 74 years can top up their superannuation by making non-concessional contributions (including under the bring-forward rules) or under salary sacrifice arrangements subject to the existing cap rules. However, retirees will still need to pass the work test to make personal deductible contributions.

It is important to note that the legislation to allow members aged 65 or 66 years to make non-concessional contributions utilising the bring-forward rules has still not passed but is likely to be imminent. This does leave retirees in this two-year age bracket in limbo in relation to topping up their non-concessional contributions.

Legacy pensions held in SMSFs

For a number of years the self-managed super fund (SMSF) sector has been asking the Federal Government to allow SMSF members with legacy pensions such as market-linked, life-expectancy and lifetime products to be able to convert to contemporary pensions, such as the Account-based pension product which came into effect from 1 July 2007. Most of these pensions were purchased under the old reasonable benefit limit (RBL) rules that restricted the amount of benefits that could be received by a member at tax concessional rates. These RBL rules were abolished as at 30 June 2007, however most legacy pensions that still existed from 1 July 2007 were non-commutable and created significant tax cost when allocating excess reserves to members. This Budget announces that the Government will allow individuals to exit these products, together with any associated reserves, for a two-year period with effect from the first financial year after Royal Assent of amending legislation.

It is important to note that if a new pension product is purchased from commuted legacy pensions, it will not be grandfathered for social security purposes and tax treatment. It also appears that there will remain some tax cost on allocation of reserves as the payment to the member will be taxed as an assessable contribution, which means that it will likely be taxed at 15 per cent. This new measure will not apply to flexi-pension products or a lifetime product in a large APRA-regulated or public sector defined benefit scheme.

Relaxation of the residency requirements for SMSFs

Many Australians spend a period of time working or studying outside Australia. This created complexity if they were members of an SMSF as the residency requirements were very restrictive and meant that if the SMSF was deemed a non-resident fund, it would suddenly be taxed as a non-complying fund with assets being taxed at a punitive rate of 47 per cent.

The Government has decided to relax these residency requirements for both SMSFs and small APRA-Regulated Funds (SAFs) by extending the central control and management test safe harbour from two to five years for SMSFs and removing the active member test for both SMSFs and SAFs. By removing the active member test, this will allow members in these funds to continue to contribute to their superannuation fund whilst temporarily overseas. This provides them with the flexibility to maintain these types of funds whilst overseas and provides parity with members of large APRA-regulated funds.

No early release of super for victims of family and domestic violence

The Government has announced that it is no longer proceeding with the measure to extend early release of superannuation to victims of family and domestic violence. This measure is no longer required given the Women’s Safety measures announced in the Budget.

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.

Although every effort has been made to verify the accuracy of the information contained on this page and on this website, Chan & Naylor, its officers, representatives, employees, and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.