Key insights

- Bringing forward personal income tax cuts should result in an immediate cash increase for most employees.

- Low income earners will receive additional support through the increase to the Low Income Tax Offset and maintaining the current Low and Middle Income Tax Offset.

- The government is removing barriers to help employees re-skill and take on new roles.

Personal income tax cuts brought forward

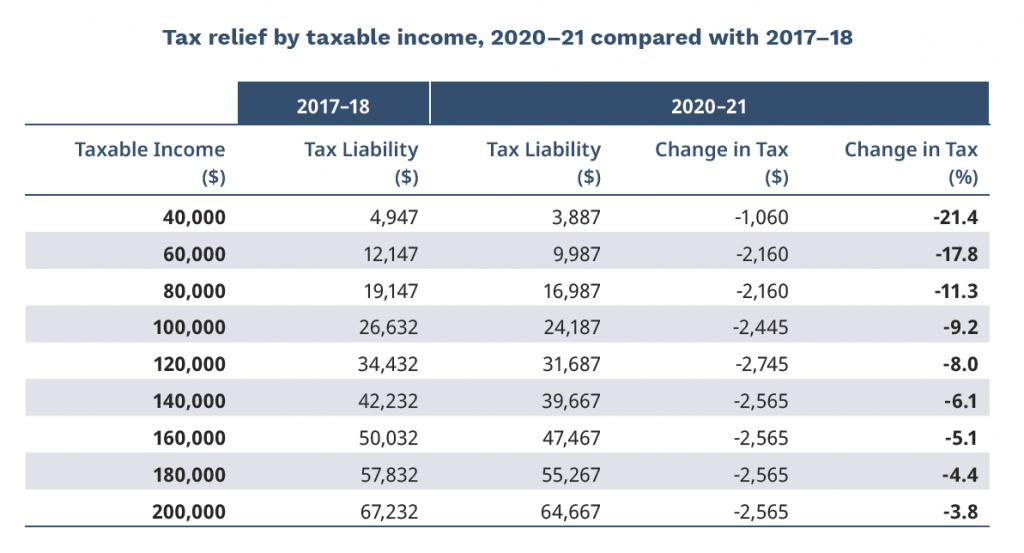

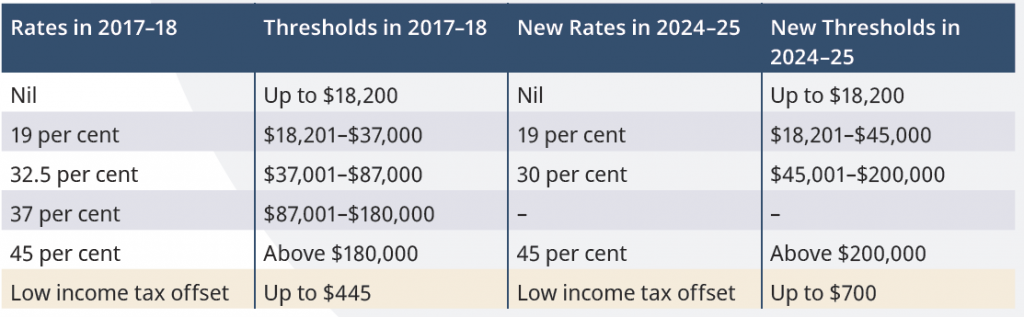

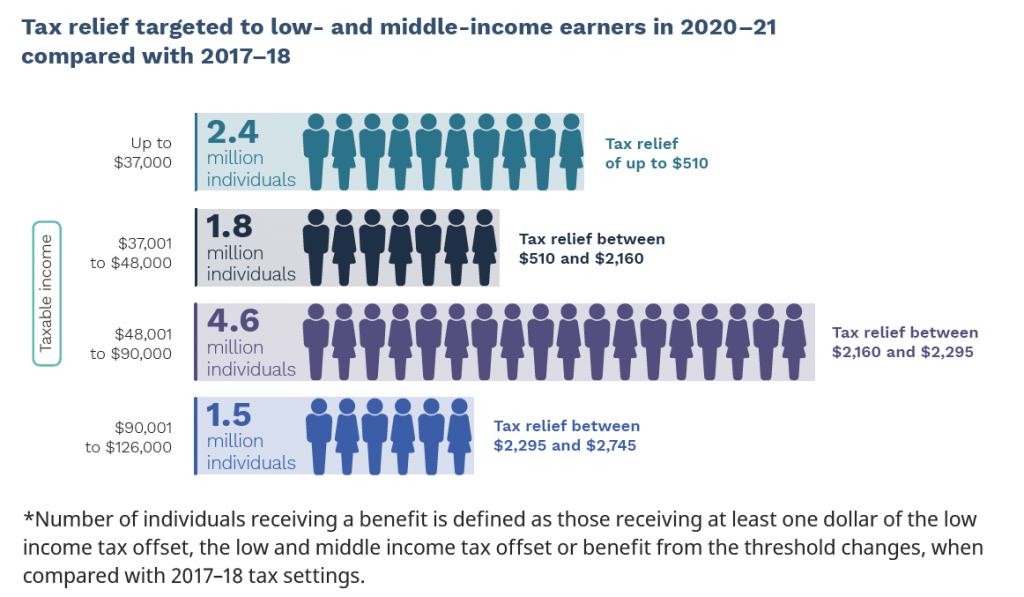

The government has brought forward the commencement date for previously legislated ‘Stage Two’ personal income tax cuts from 1 July 2022 to 1 July 2020. The cuts increase the upper threshold of the 19 per cent tax bracket from $37,000 to $45,000, and the upper threshold of the 32.5 per cent tax bracket from $90,000 to $120,000. The retroactive start date will mean an immediate cash increase for most employees.

The commencement date for the ‘Stage Three’ personal income tax cuts (which predominantly impacts middle-to-high income earners) has not been changed in this Budget and remains as 1 July2024. The proposed income tax rates are:

Relief for low income earners

The Budget provides further relief for low income earners through an increase to the Low Income Tax Offset from $445 to $700. This relief applies from 1 July 2020 and will be available through the 2020-21 personal income tax returns. The current Low and Middle Income Tax Oset of up to $1,080 will remain in place for 2020-21. This Offset was originally scheduled to cease when the ‘Stage Two’ tax cuts came into effect.

Costs for retraining employees

Currently, training provided to employees that is not sufficiently connected to their current role is subject to fringe benefits tax (FBT) for employers. This budget seeks to support redeployment of individuals into new roles by providing a specific FBT exemption for all retraining costs provided by employers to redundant, or soon to be redundant, employees. The Government will also undertake consultation to consider allowing a personal income tax deduction where the costs of retraining are funded directly by the individual.

Removal of Capital Gains Tax for granny flats

A specific exemption from tax on capital gains will be introduced for formal granny flat arrangements with older Australians or those with a disability. The measure is intended to remove tax impediments for families creating formal arrangements and will likely come into effect from 1 July 2021.

General Advice Warning

The material on this page and on this website has been prepared for general information purposes only and not as specific advice to any particular person. Any advice contained on this page and on this website is General Advice and does not take into account any person’s particular investment objectives, financial situation and particular needs.

Before making an investment decision based on this advice you should consider, with or without the assistance of a securities adviser, whether it is appropriate to your particular investment needs, objectives and financial circumstances. In addition, the examples provided on this page and on this website are for illustrative purposes only.

Although every effort has been made to verify the accuracy of the information contained on this page and on this website, Chan & Naylor, its officers, representatives, employees, and agents disclaim all liability [except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this website or any loss or damage suffered by any person directly or indirectly through relying on this information.