What are Fuel Tax Credits?

Fuel tax credits are a financial return for businesses to offset the cost of fuel tax, including excise or customs duty, on fuel used in business operations like running machinery, equipment, heavy vehicles, and light vehicles on private pathways. This measure is designed to help businesses reduce their fuel-related expenses, making it a beneficial aspect of managing operational costs effectively.

Who can claim fuel tax credits?

Businesses can claim credits for eligible fuels including diesel, petrol, and certain blended fuels, among others. Business activities that qualify typically involve the use of machinery, vehicles, and equipment in operations such as agriculture, construction, and transportation. However, small vehicles weighing less than 4.5 tonnes that drive on public roads usually don’t qualify for these credits.

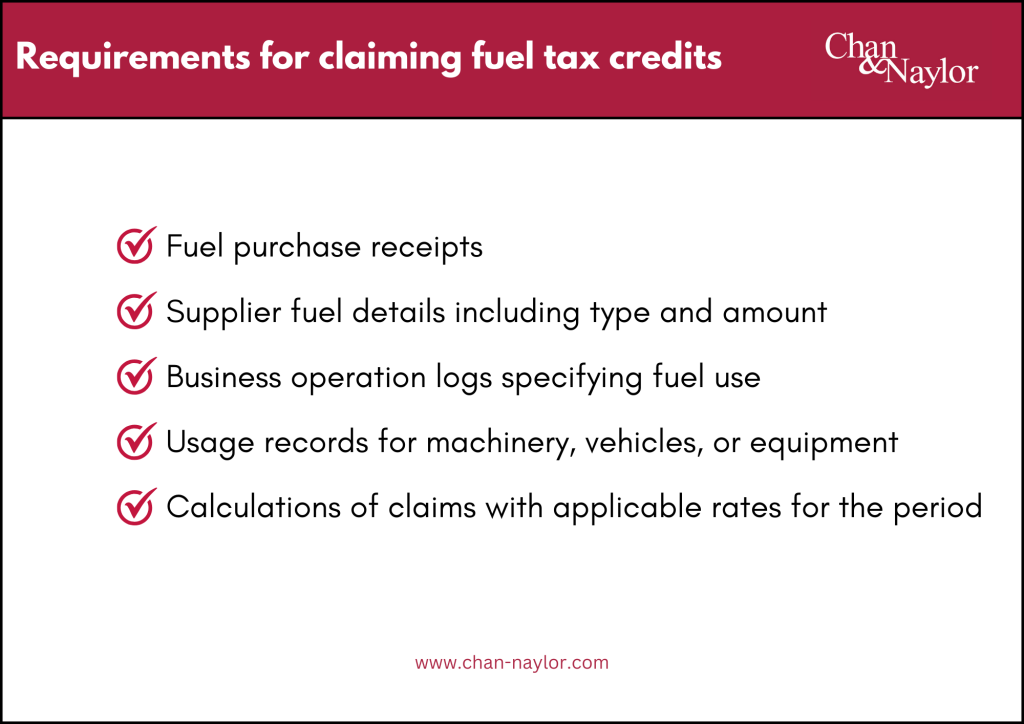

Requirements for claiming fuel tax credits

When claiming fuel tax credits, the Australian Taxation Office requires businesses to maintain accurate records to substantiate their claims. These records should include:

- Detailed receipts for fuel purchases.

- Documents from suppliers providing information about the fuel, including the type and quantity.

- Logbooks or records that show the use of fuel within the business operations, distinguishing between eligible business activities and ineligible ones.

- Records that demonstrate how the fuel is used, whether for powering machinery, vehicles, or equipment.

- Calculations and workings out that show how you’ve arrived at the claimed amount using the correct fuel tax credit rates applicable for the period when the fuel was acquired.

These records must be kept to provide evidence for the fuel tax credit claim, and they are crucial if ever the ATO needs to review or audit your claim. For more specific details on the documentation required and tips on maintaining these records, seek professional advice from Chan & Naylor to ensure compliance and accuracy in your claims. Learn more about the services we can offer to assist you in maximizing your tax claims.

How to calculate fuel tax credits

Calculating fuel tax credits involves a few key steps:

1. Identify eligible fuel quantity

Start by figuring out how much eligible fuel you’ve used for business activities. Remember, not all fuel use qualifies, so focus on fuel used in operations like machinery operation, transportation, or equipment running.

2. Determine the applicable rate

Fuel tax credit rates can vary based on the type of fuel and its use. Check the latest rates on the ATO website to find out which rate applies to the fuel you’ve used.

3. Calculate your credit

Multiply the quantity of eligible fuel by the applicable rate to find out your fuel tax credit amount. This will give you the total credit you can claim for the period.

The Australian Taxation Office (ATO) provides tools and calculators on their website to assist businesses in accurately calculating their claims. This process ensures businesses claim the correct amount and remain compliant

How to claim fuel tax credits?

To make a claim, businesses need to fill out the specific sections related to fuel tax credits on their Business Activity Statement (BAS). This form is a key component of tax filing and reporting for Australian businesses, including various tax obligations, including Goods and Services Tax (GST), Pay As You Go (PAYG) installments, and fuel tax credits.

Timing plays a critical role in this process. Businesses are required to lodge their claims within a four-year window from the due date of the BAS period during which the fuel was purchased. This limitation underscores the importance of maintaining up-to-date records and staying on top of filing deadlines to ensure that potential credits are not forfeited due to oversight or delay.

Methods of claiming tax fuel credits

The Australian Taxation Office (ATO) offers different methods for businesses to claim fuel tax credits, allowing for flexibility based on the nature of the business and the complexity of their fuel usage. Here’s a brief overview of the different methods:

Basic Method

For businesses with simpler fuel tax credit claims, the ATO provides straightforward rates and methods to calculate credits without extensive record-keeping. For example, the ‘basic method for heavy vehicles’ simplifies the process for businesses that claim less than $10,000 in credits per year.

Simplified Methods for Vehicles with Auxiliary Equipment

There are simplified methods for calculating fuel used in vehicles with auxiliary equipment, which often include a set percentage of fuel use that’s eligible for credits. The ATO provides tables with percentages for different vehicle types and equipment.

Actual Usage Method

For businesses with more complex situations or multiple uses for their fuel, the actual usage method involves detailed record-keeping and calculations. This includes keeping logs of fuel use for different activities, equipment, or vehicles, and applying the correct rates accordingly.

Apportionment Methods

These methods are used when fuel is used for both eligible and ineligible activities. They involve apportioning the fuel use based on the eligible business activity. Acceptable apportionment methods can include constructive, deductive, and percentage use methods, among others.

Other Methods

For some businesses, especially those with specialized equipment or particular operating conditions, other methods may be necessary. This could involve trials or tests to determine fuel consumption for specific equipment or using data from engine diagnostic downloads.

Amending Claims

If you’ve previously claimed using one method and then find that another method would have been more accurate or beneficial, you may be able to amend your claim within the time limits set by the ATO.

Choosing the right method depends on the complexity of your business’s fuel use, the amount you’re claiming, and the resources available for record-keeping and calculation. For businesses unsure of which method to use, or for those with more complex fuel use, it’s advisable to seek professional advice to ensure accuracy and compliance with ATO regulations. At Chan & Naylor, we have a team of highly skilled accountants specializing in business tax.

Updates and changes in fuel tax credits

Staying abreast of updates and changes in fuel tax credits is crucial for businesses to ensure they’re maximizing their claims accurately. The ATO regularly updates rates and eligibility criteria, which can affect how much you’re able to claim. Regularly consulting with your tax professional can help keep your business informed and compliant.

We’re here to help

If diving into fuel tax credits seems overwhelming, don’t worry, Chan & Naylor has got your back. With a skilled team of business tax experts, we’re here to help you get the most out of your claims. Ready to maximize your credits without the stress? Let’s chat.

Disclaimer

This guide serves as general advice and may not account for the unique circumstances of individual readers. For personalised and strategic solutions tailored to your specific situation, we invite you to seek professional advice from Chan & Naylor. Our highly experienced team is dedicated to helping you navigate the complexities of Australian taxation, ensuring that your financial strategies align with the latest regulations. Contact us today to embark on a path of informed and customised tax planning for your property investments.