What is record-keeping?

Record-keeping is the systematic organisation of all business financial activities, crucial for depicting your business’ fiscal health. It involves documenting transactions, managing payroll, and ensuring compliance with financial and regulatory requirements.

What is a business record?

Business records are documents such as sales invoices and bank statements that chronicle your business’ financial and administrative transactions, providing transparency and accountability to business management and tax governance.

Difference between bookkeeping and record-keeping

While record-keeping involves the systematic organisation of financial activities, it’s important to note that bookkeeping is an integral part of this process. Most bookkeeping software allows uploading and attaching documents when posting financial transactions. This serves as a good record keeping and tracing mechanism to supplement the traditional document filing system.

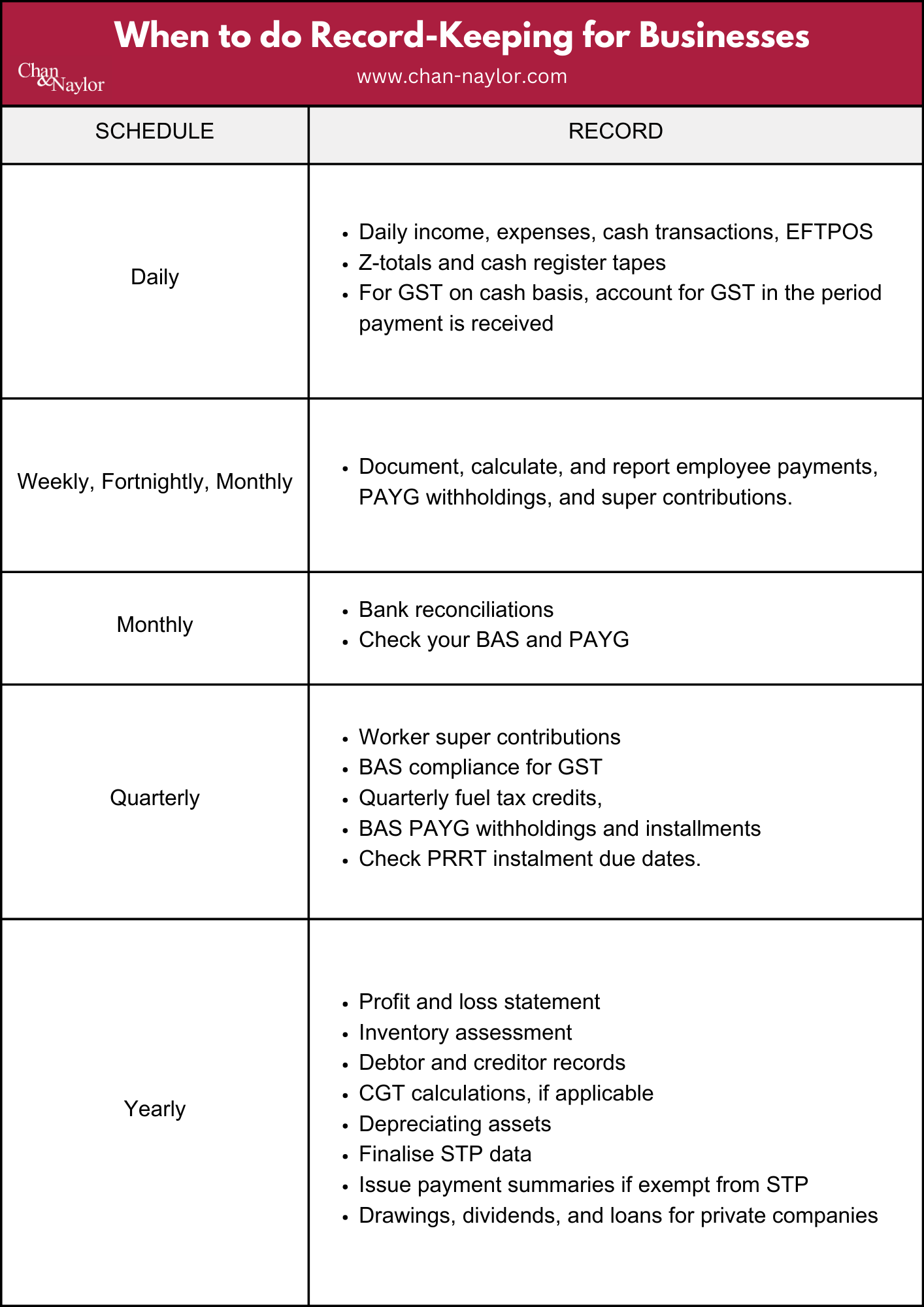

When to do record-keeping?

To effectively manage your business’s financial health, it’s crucial to engage in regular record-keeping. This involves daily documentation of transactions, weekly or monthly reviews of payroll and reconciliations, quarterly assessments for GST and superannuation, and annual preparations for tax filing. Each step ensures compliance, accuracy in financial reporting, and strategic planning.

Daily record-keeping

Start by documenting every transaction—sales, expenses, and cash movements. Regular reconciliation of sales, including EFTPOS (Electronic Funds Transfer at Point Of Sale) and cash, ensures the accuracy of your records.

Weekly, Fortnightly, Monthly

Payroll is a recurring task. Reporting through STP-enabled software helps manage PAYG withholdings and super contributions efficiently.

Quarterly

This period is vital for GST reporting, superannuation contributions, and PAYG withholdings. Accurate record-keeping supports effective BAS preparation.

Annually

Year-end is the time for comprehensive financial reviews. Summarise income and expenses, conduct stocktakes, and finalise employee data through STP (Single Touch Payroll).

Thorough record-keeping, supported by solid bookkeeping, not only helps keep your business compliant but also sets the stage for smart decision-making and financial stability.

Record-keeping challenges for small businesses

We understand that record-keeping can be a burden for many small businesses, especially when owners have limited time resources while working on all aspects of the business. The demands of day-to-day operations often leave little room for meticulous financial documentation.

We’re here to help

Effective record-keeping and bookkeeping are critical components of business success. Recognising the challenges small businesses face, we are here to assist. Chan & Naylor is committed to providing tailored solutions that ease the burden of financial management. Let us help you navigate the complexities of record-keeping, ensuring compliance and empowering your business with strategic financial insights. Partner with us at Chan & Naylor, and let’s elevate your financial practices to drive your business forward.

Disclaimer

This guide serves as general advice and may not account for the unique circumstances of individual readers. For personalised and strategic solutions tailored to your specific situation, we invite you to seek professional advice from Chan & Naylor. Our highly experienced team is dedicated to helping you navigate the complexities of Australian taxation, ensuring that your financial strategies align with the latest regulations. Contact us today to embark on a path of informed and customised tax planning for your property investments.