The Australian Tax Office (ATO) has secured a noteworthy win in court against SingTel regarding its purchase of Optus, marking a significant moment for tax compliance among multinational corporations. This victory underscores the necessity for companies to adhere to equitable tax practices, particularly in transactions within their own corporate groups. The case sends a strong signal from the ATO to multinational entities about the critical importance of following established tax laws. As an accounting firm, our aim is to clearly explain the essence of this ruling, its implications, and how it serves as a guide for businesses to ensure they meet their tax obligations responsibly. Let’s explore the fundamental aspects of the ATO’s ruling and its impact on the global business landscape.

The Case at a Glance

SingTel bought Optus to grow its global telecom presence in the early 2000s. However, the Australian Tax Office (ATO) disputed the tax deductions SingTel claimed on the inter-company loans used to finance the deal, contending that the interest rates didn’t match market rates. The Full Federal Court agreed with the ATO, confirming that SingTel’s tax deductions were not in line with transfer pricing rules that demand related companies trade at market value. This landmark decision reaffirms tax law adherence and serves as a warning: corporate tax dealings must be legitimate and transparent to ensure proper taxation and prevent profit shifting.

Key Findings and Legal Standpoints

The Full Federal Court’s ruling in favor of the Australian Tax Office (ATO) against SingTel centers around a critical aspect of tax law: transfer pricing. Transfer pricing regulations ensure that transactions between subsidiaries of the same multinational corporation are conducted as if the entities were independent, preventing companies from shifting profits to lower-tax jurisdictions through inflated or deflated prices.

In the SingTel case, the court scrutinized the interest rates applied to loans between SingTel’s subsidiaries involved in the Optus acquisition. The interest deductions claimed by SingTel on these loans were contested by the ATO, which argued that the rates did not reflect what would have been agreed upon between unrelated parties under the same circumstances. This misalignment suggested an attempt to minimize taxable income in Australia by overstating interest expenses, thereby shifting profits within the corporate group.

The court’s decision to deny SingTel’s interest deduction claims was based on a thorough examination of the amendments made to the loan agreements over time. These amendments significantly increased the interest rates, which the court found to lack commercial justification had the parties been independent of one another. This finding was pivotal, illustrating that the financing structure between SingTel’s subsidiaries did not adhere to the arm’s length principle, a cornerstone of transfer pricing rules.

Furthermore, the court’s ruling underscores the expectation that multinational corporations must base their intra-group financial transactions on commercial realities, rather than tax optimization strategies. This emphasis on the arm’s length principle reaffirms the integrity of transfer pricing rules to curb tax avoidance and ensure fair competition.

Implications for Multinational Corporations

The ruling in the SingTel and Optus case sets a precedent with far-reaching implications for multinational corporations operating within and beyond Australian borders. It serves as a clear indicator of the ATO’s stance on transfer pricing and intra-group financing strategies, emphasizing the critical need for compliance with tax laws and regulations. Here are the key implications for multinational corporations stemming from this landmark decision:

Stringent Scrutiny on Transfer Pricing: Multinational companies must now anticipate a more rigorous examination of their transfer pricing practices, especially regarding financial transactions like loans and interest deductions between subsidiaries. The ATO’s successful challenge in this case demonstrates its capability and willingness to scrutinize arrangements that may not align with the arm’s length principle.

Emphasis on Commercial Justification: The court’s decision highlights the importance of ensuring that all intra-group transactions have a solid commercial basis. Companies must be prepared to demonstrate that their financial arrangements, including the terms and rates of intra-group loans, would be comparable to those agreed upon with independent entities under similar conditions.

Increased Compliance and Documentation Requirements: In light of this ruling, multinational corporations should expect to face more stringent documentation requirements to prove their compliance with transfer pricing rules. This includes detailed records of how prices, interest rates, and terms are determined for transactions between related entities, ensuring they reflect market conditions.

Risk of Reassessment and Penalties: The case serves as a warning that companies engaging in practices deemed non-compliant with tax laws may face reassessments, additional tax liabilities, and penalties. It underscores the financial and reputational risks of aggressive tax planning strategies aimed at profit shifting.

Guidance for Future Transactions: For multinational corporations, this ruling offers valuable insights into how future intra-group transactions should be structured. It encourages the adoption of transparent, market-based pricing and financing practices, which can withstand legal and regulatory scrutiny.

Global Impact Beyond Australia: While this decision emanates from the Australian judicial system, its implications extend globally. Countries around the world are increasingly collaborating to combat tax avoidance and ensure fair taxation of multinational enterprises. This case may inspire similar actions and legal standards in other jurisdictions, influencing global tax compliance strategies.

Lessons Learned and Best Practices

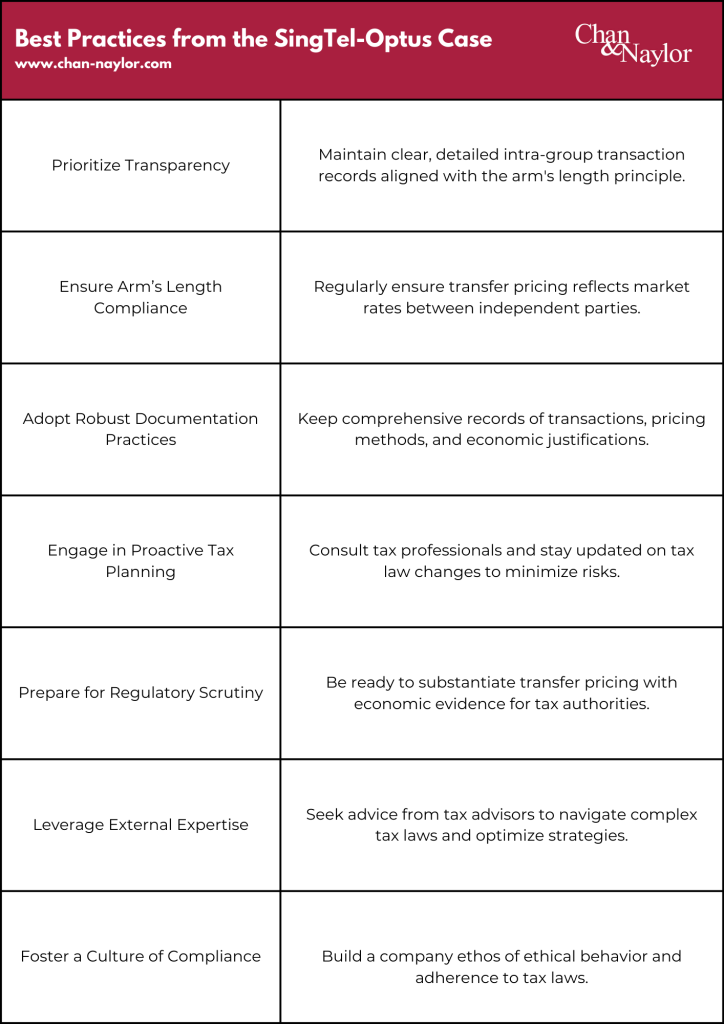

The SingTel-Optus case offers several key lessons and best practices for multinational corporations aiming to navigate the complex landscape of tax compliance and transfer pricing. These insights can help companies not only to avoid legal pitfalls but also to foster a culture of transparency and accountability in their financial practices. Here are some of the critical takeaways:

Prioritize Transparency: Companies should strive for complete transparency in their intra-group transactions. This includes maintaining clear, detailed documentation that justifies the commercial rationale behind pricing, loan terms, and interest rates, ensuring they align with the arm’s length principle.

Ensure Arm’s Length Compliance: The core of transfer pricing regulations is the arm’s length principle. Corporations must regularly review their transfer pricing policies and practices to ensure they reflect what independent parties would agree upon under comparable circumstances. This involves conducting regular transfer pricing analyses and benchmarking studies.

Adopt Robust Documentation Practices: Effective documentation is critical in demonstrating compliance with transfer pricing rules. Companies should develop and maintain comprehensive documentation that covers the nature of the transactions, the methods used to determine pricing, and the economic analysis supporting these decisions.

Engage in Proactive Tax Planning: While tax optimization is a legitimate business goal, companies must approach it within the bounds of legal and ethical standards. Engaging in proactive tax planning, which includes consulting with tax professionals and staying informed about changes in tax laws and regulations, can help companies make informed decisions that minimize risk.

Prepare for Regulatory Scrutiny: Multinational corporations should be prepared for increased scrutiny from tax authorities, not just in Australia but globally. This includes being ready to defend transfer pricing positions through sound economic arguments and empirical evidence, highlighting the arm’s length nature of their transactions.

Leverage External Expertise: Given the complexities of transfer pricing and international tax law, seeking advice from external tax advisors and consultants can provide valuable insights and help companies navigate the regulatory landscape more effectively. These professionals can assist in conducting risk assessments, preparing documentation, and formulating strategies that align with current legal standards.

Foster a Culture of Compliance: Cultivating a corporate culture that values ethical behavior and compliance with tax laws is essential. This involves training staff in the importance of transfer pricing regulations and ensuring that tax compliance is integrated into the company’s broader corporate governance framework.

By adhering to these best practices, multinational corporations can not only mitigate the risk of non-compliance and potential legal challenges but also contribute to fair and equitable tax systems worldwide. The SingTel-Optus case serves as a potent reminder of the importance of diligent, transparent, and lawful tax practices in today’s global business environment.

The Tax Avoidance Taskforce’s Role

The ATO’s win against SingTel highlights the Tax Avoidance Taskforce’s pivotal role in promoting tax compliance. This team, created to confront tax avoidance by large firms and multinationals, bolsters the ATO’s ability to enforce tax laws and ensures fair tax contributions. The Taskforce’s achievements demonstrate stronger enforcement and discourage aggressive tax strategies through visible action and guidance. Internationally, the Taskforce collaborates to tighten tax regulations and shape reforms, thus supporting global tax fairness. Their work fosters trust in the tax system and underscores the government’s commitment to tax integrity and equity. The SingTel outcome exemplifies the Taskforce’s influence and serves as a warning against tax evasion attempts.

We’re here to help

If you’re seeking to fine-tune your tax strategies or simply have questions about how these laws apply to your business, we’re ready to assist. Our seasoned team offers personalized assistance for your business’s tax compliance needs. Contact us to optimize your tax strategies and navigate complex laws with ease, ensuring transparency and fairness in the global market. Let’s achieve tax compliance and operational success together.

About Chan & Naylor

Founded in 1990, we have partnered with thousands of businesses all over Australia. Choosing Chan & Naylor means you’re not just selecting a service provider; you’re gaining a partner aligned with your financial goals. You’ll have access to a dedicated client manager supported by a team of accountants that specialises in business tax and investments.

Disclaimer

This article serves as general information only and may not account for the unique circumstances of individual readers. For personalised and strategic solutions tailored to your specific situation, we invite you to seek professional advice from Chan & Naylor. Our highly experienced team is dedicated to helping you navigate the complexities of Australian taxation, ensuring that your financial strategies align with the latest regulations. Contact us today to embark on a path of informed and customised tax planning for your property investments.