What is a Director Identification Number?

A Director Identification Number, commonly known as a DIN, serves as a unique identifier for directors and plays a pivotal role in enhancing transparency and accountability within the corporate sector. Mandated by recent legislative reforms, the Australian Taxation Office (ATO) has been tasked with overseeing the implementation of DINs.

What is the purpose of Director Identification Number?

Director Identification Numbers are designed to enhance transparency and accountability within the corporate sector. By assigning each director their own DIN, regulators can better track and monitor directorial activities, ensuring that businesses operate with integrity. DINs also play a crucial role in preventing illegal phoenix activity, fraud, and identity theft, ultimately fostering a fairer and more trustworthy business environment for everyone involved. With DINs in place, you can feel confident knowing that steps are being taken to uphold the integrity of Australia’s corporate landscape.

Who needs a Director Identification Number?

DINs are required for both current and prospective directors of Australian companies, as well as directors of foreign companies operating within Australia’s jurisdiction

- Current and Future Directors: Individuals currently holding directorial positions in Australian companies are required to obtain a DIN. Additionally, individuals slated to become directors in the future must also acquire a DIN.

- Directors of Foreign Companies Operating in Australia: Directors of foreign companies operating within the jurisdiction of Australia are also mandated to obtain a DIN.

- Transition Period for Existing Directors: Existing directors are granted a transition period to apply for their DINs, ensuring ample time for compliance with the new regulatory framework.

- New Directors: New directors must obtain a DIN before assuming their roles within a company, underscoring the importance of compliance from the outset of their directorial tenure.

Application Process for DIN

Navigating the application process for a Director Identification Number (DIN) through the Australian Taxation Office (ATO) can seem daunting, but it’s essential for compliance. For more details on the step-by-step process in applying for DIN, read more here.

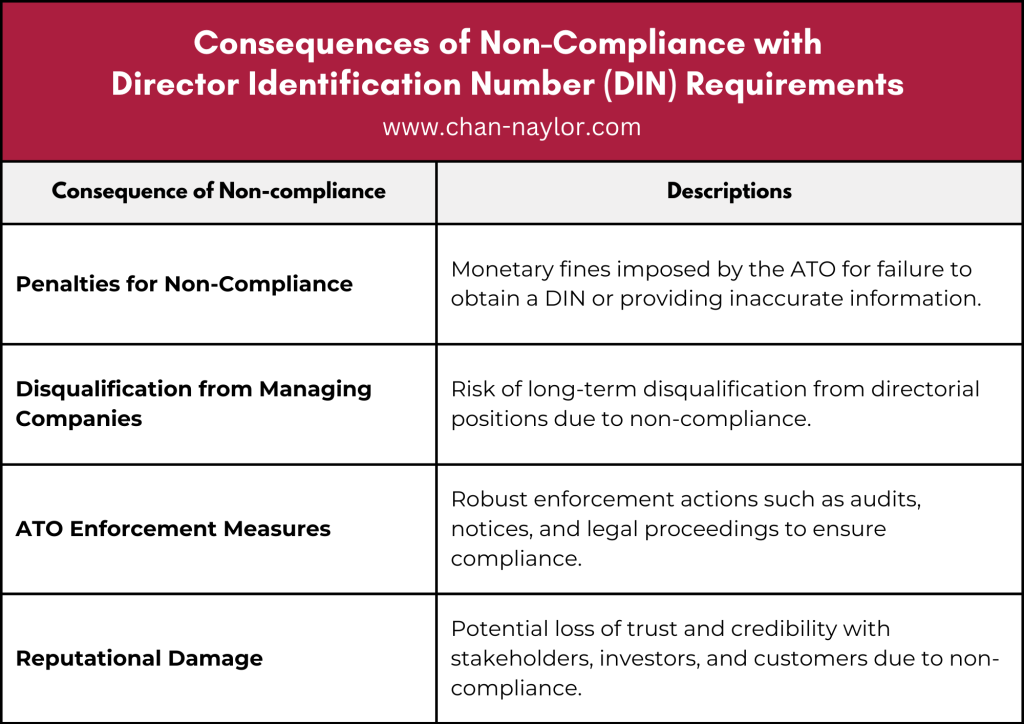

Consequences of Non-Compliance

Failing to comply with Director Identification Number (DIN) requirements can have serious repercussions for directors and businesses in Australia. Here’s what you need to know about the potential consequences:

1. Penalties for Non-Compliance

Directors who fail to obtain a DIN or provide inaccurate information may face significant penalties, including monetary fines imposed by the Australian Taxation Office (ATO). These fines can vary depending on the severity of the non-compliance.

2. Disqualification from Managing Companies

In addition to financial penalties, non-compliant directors may also risk disqualification from managing companies. This could have long-term implications for their ability to hold directorial positions in the future.

3. ATO Enforcement Measures

The ATO takes non-compliance with DIN obligations seriously and has implemented robust enforcement measures to ensure compliance. This may include conducting audits, issuing notices to directors, and taking legal action against repeat offenders.

4. Reputational Damage

Non-compliance with DIN requirements can also result in reputational damage for directors and their associated businesses. This can impact relationships with stakeholders, investors, and customers, potentially leading to loss of trust and credibility.

It’s essential for directors to understand their obligations regarding DINs and take proactive steps to ensure compliance. By obtaining a DIN and providing accurate information, directors can avoid the severe consequences of non-compliance and contribute to a transparent and accountable corporate sector in Australia.

Benefits of DINs for Businesses

Director Identification Numbers (DINs) offer numerous benefits for both individual directors and the broader business community in Australia. Here’s why DINs are valuable:

- Enhanced Credibility and Trustworthiness: Having a DIN can enhance a director’s credibility and trustworthiness in the eyes of investors, lenders, and potential business partners. It serves as a tangible demonstration of a director’s commitment to transparency and accountability, instilling confidence in stakeholders.

- Facilitated Access to Financing: Directors with DINs may find it easier to secure financing for their businesses. Lenders and financial institutions are more likely to lend to directors who have undergone the DIN verification process, as it provides assurance regarding their identity and directorial history.

- Attractiveness to Investors: DINs can make businesses more attractive to investors, particularly institutional investors and venture capitalists who prioritise corporate governance and compliance. The presence of DINs signals a commitment to good governance practices, which can positively influence investment decisions.

- Support for Business Partnerships: DINs can facilitate the formation of business partnerships and collaborations. Potential partners may view directors with DINs as more reliable and trustworthy, making it easier to establish mutually beneficial relationships.

- Promotion of Transparency and Accountability: By requiring directors to obtain DINs, regulators promote transparency and accountability within the corporate sector. DINs contribute to a more transparent and reputable business environment, where directors are held accountable for their actions.

- Benefits for the Broader Economy: A transparent and reputable corporate sector benefits the broader economy by fostering investor confidence, promoting fair competition, and reducing the risk of corporate misconduct. DINs play a crucial role in achieving these objectives and contribute to the overall health and stability of the economy.

DINs offer tangible benefits for businesses and directors alike, ranging from enhanced credibility and access to financing to the promotion of transparency and accountability within the corporate sector. By embracing DINs, directors can position themselves and their businesses for long-term success in an increasingly competitive business landscape.

Next Steps

Director Identification Numbers (DINs) represent a significant step towards enhancing transparency and accountability in Australia’s corporate sector. As directors and businesses navigate the complexities of DIN compliance, it’s essential to seek expert guidance to ensure smooth and effective implementation.

We’re here to help

For personalised assistance with DIN compliance and other accounting needs, reach out to Chan & Naylor. Our team of highly skilled accountants possesses the expertise and experience to guide you through the DIN application process and provide comprehensive support for your business requirements. Contact us today to learn how we can help you achieve compliance and drive success in your business endeavors.

About Chan & Naylor

Since 1990, Chan & Naylor has partnered with businesses and investors in managing their taxes and building a tax-effective wealth. Choosing Chan & Naylor means you’re not just selecting a service provider; you’re gaining a partner aligned with your financial goals. You’ll have access to a dedicated client manager supported by a team of accountants that specialises in business and property tax.

Disclaimer

This guide serves as general advice and may not account for the unique circumstances of individual readers. For personalised and strategic solutions tailored to your specific situation, we invite you to seek professional advice from Chan & Naylor. Our highly experienced team is dedicated to helping you navigate the complexities of Australian taxation, ensuring that your financial strategies align with the latest regulations. Contact us today to embark on a path of informed and customised tax planning for your property investments.