Discover the latest updates in superannuation contributions brought to you by Chan & Naylor. The Federal government has just announced significant changes to contribution caps, set to take effect from July 1, 2024. Let’s explore these changes and their potential impact on your financial strategies.

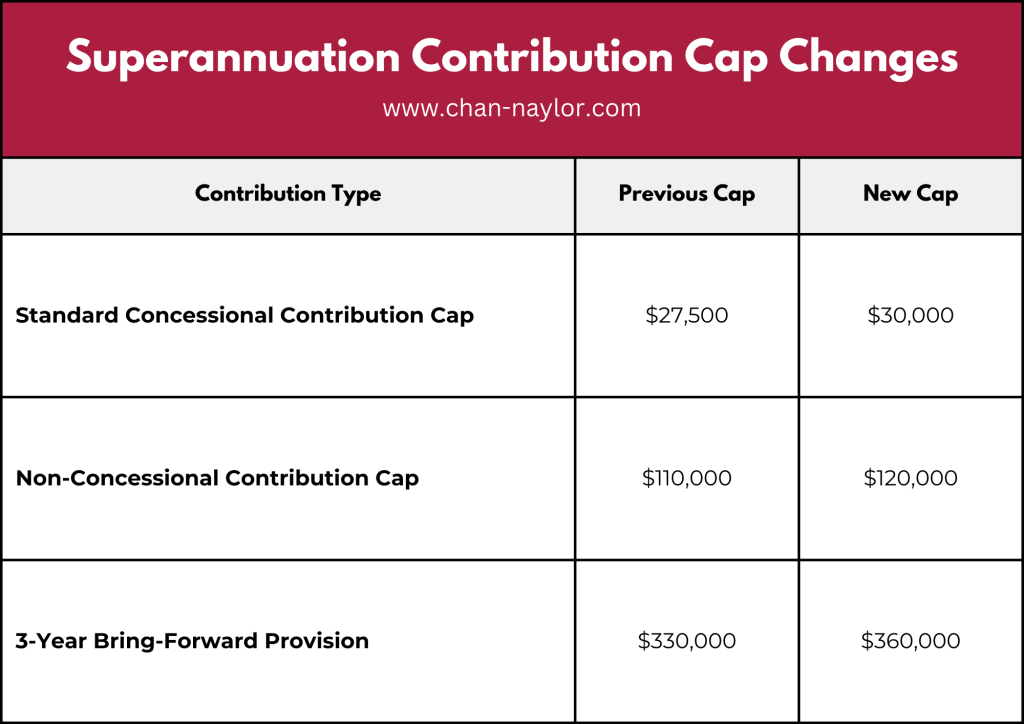

The recent announcement by the Federal government outlines several key adjustments to contribution caps, aimed at enhancing superannuation benefits for Australians. Firstly, the standard concessional contribution cap will see a notable increase from $27,500 to $30,000. This adjustment presents an opportunity for individuals to boost their retirement savings through increased concessional contributions.

Additionally, the non-concessional contribution cap, which is calculated as four times the standard concessional contribution cap, will rise from $110,000 to $120,000. This expansion allows individuals to contribute more towards their superannuation on a non-concessional basis, further bolstering their retirement nest egg.

As a result of the annual limit increase for non-concessional contribution, the 3-year bring-forward provisions will climb from $330,000 to $360,000. The Total Superannuation Balance thresholds corresponding to the bring-forward non-concessional contributions have also been updated accordingly.

For individuals who have initiated a 2 or 3-year bring-forward period

For individuals already in a 2 or 3-year bring-forward period, it is important to bear in mind that those currently in such a period will not see an immediate benefit from the increase. Take for instance, someone with a total super balance of $1.7 million who contributes $220,000 in 2023/24 under the 2-year bring-forward rules. Despite the cap increase, they are still capped at $220,000 until their current bring-forward period concludes.

We’re here to help

Excited about these upcoming changes to contribution caps? At Chan & Naylor, we understand the importance of optimising your financial plans considering evolving regulations. Our team of experienced SMSF accountants and advisors is here to provide personalised guidance and tailored solutions to help you make the most of these opportunities.

Whether you’re an individual looking to maximise your superannuation contributions, streamlining your self-managed super fund or seeking strategic advice and SMSF administration support, we’re here to assist you every step of the way. Reach out to us today to schedule a consultation and take proactive steps towards securing your financial future.