What is Fringe Benefits Tax (FBT)?

Fringe Benefits Tax, commonly known as FBT, is a tax employers pay on certain benefits they provide to their employees, including their employees’ family or other associates. The benefit may be in addition to, or part of, their salary or wages package. FBT is separate from income tax and is based on the taxable value of the various fringe benefits provided.

FBT exemption for Electric Vehicles

To support environmental sustainability, the Australian Government offers FBT exemptions for eligible electric vehicles, including fully electric, hydrogen fuel cell, and certain hybrids, promoting greener company fleets.

Impact of the exemption on business owners and employees

For employers, this exemption could significantly decrease the cost of adopting greener transportation solutions and align with the organisation’s sustainability goals. For employees, this shift means potentially lower personal tax liabilities and the opportunity to engage in more sustainable commuting practices. The ripple effect of your participation in this initiative extends beyond immediate financial savings, contributing to a wider societal push towards reduced carbon footprints and pioneering the future of electric vehicle technology and infrastructure.

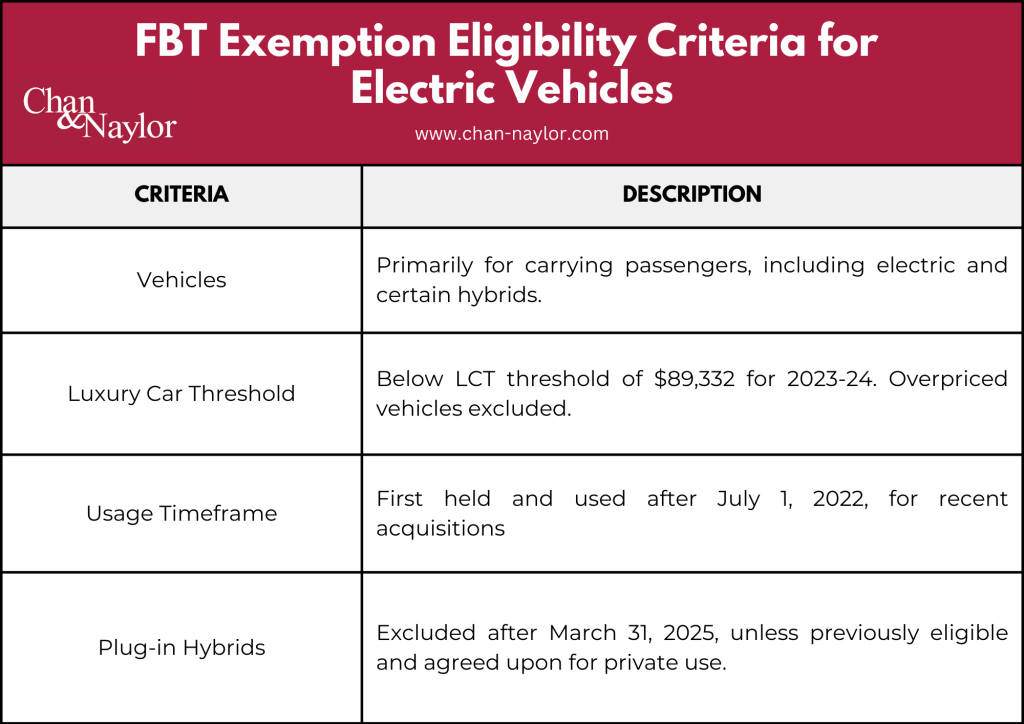

Eligibility criteria

Vehicles

These must be designed primarily for carrying passengers, including fully electric and certain hybrids, to ensure that they align with the prescribed standards set out by the governing tax authorities.

Luxury Car Threshold (LCT)

Electric vehicles must fall below a certain cost to be eligible for the FBT exemption. This cost is dictated by the Luxury Car Tax (LCT) threshold, which is determined each financial year. For the 2023-24 financial year, the threshold is set at $89,332. Vehicles priced above this limit at the time of their first retail sale are excluded from the FBT exemption.

Usage timeframe

To qualify, your electric vehicles must be first held and used on or after July 1, 2022. This ensures that only recent acquisitions benefit from the exemption, promoting the purchase of newer, more efficient models.

Plug-in hybrids

If your fleet includes plug-in hybrid electric vehicles, be aware of their particular conditions for exemption. These hybrids will be excluded from the FBT exemption after March 31, 2025, unless they were both eligible and subject to a binding agreement for private use before this cut-off date. This condition encourages a more permanent transition to fully electric vehicles by gradually phasing out incentives for hybrids.

Employer-employee relationship

For the FBT exemption on electric vehicles to apply, there must be a formal employer-employee relationship. This means that the benefits provided, including the use of an electric vehicle, must be directly connected to the employment. It’s this link that enables the FBT exemption to be considered, as the benefit is seen as part of the employment package.

Partners and sole traders aren’t eligible

Partners of a partnership and sole traders cannot take advantage of the FBT exemption for themselves. This is because they are not considered employees within their own entities for FBT purposes. They may, however, provide benefits to their employees, if any, which could potentially be eligible for FBT exemptions.

Scope of exemption

Components covered under the exemption

The exemption from FBT covers various associated costs such as registration, insurance, and maintenance for eligible electric vehicles. These are considered ancillary benefits to the use of the vehicle and are included under the umbrella of the FBT exemption.

Exclusions from the exemption

Certain benefits, such as the installation of home charging stations, are not covered by the FBT exemption. While integral to the use of electric vehicles, these are treated separately for tax purposes and constitute a separate fringe benefit.

Reporting obligations for exempt benefits

Despite the FBT exemption, the value of the provided electric vehicle still needs to be reported on the employee’s income statement. This reporting is crucial for assessing adjusted taxable income, which can affect eligibility for certain government benefits and obligations.

Reporting and calculating benefits

Applying the ATO’s shortcut method

The Australian Taxation Office (ATO) has introduced a streamlined approach to simplify how employers calculate fringe benefits for electric vehicle usage. This shortcut method assigns a fixed rate per kilometer for the use of electric vehicles, designed to reflect the cost of electricity consumed for business travel. It’s a straightforward calculation that bypasses the need for detailed logs of electricity usage per trip, making compliance easier for businesses. This method ensures that employers can efficiently account for the electric vehicle’s operational costs without delving into intricate calculations.

Exploring alternative methods for calculating benefits

However, the shortcut method might not fit all circumstances, especially when an employer seeks to demonstrate a more accurate cost of electric vehicle operation or when the vehicle’s use does not align neatly with the shortcut parameters. In such cases, employers are encouraged to develop alternative methods for calculating these benefits. This could involve tracking the actual electricity usage of the vehicle, using GPS data to monitor distances traveled and then applying the cost of electricity per kilometer. The key is ensuring that whatever method chosen can stand up to scrutiny, accurately reflecting the vehicle’s use and the associated costs. Employers might consider consulting with tax professionals to devise a method that is both compliant and reflective of their specific situation.

Effect of reportable fringe benefits on taxable income

It’s crucial to understand the ramifications of reportable fringe benefits. While the FBT exemption for electric vehicles reduces the tax burden on employers, the benefits still need to be reported on the employee’s income statement as reportable fringe benefits. This does not directly increase the employee’s taxable income but may influence other tax-related calculations. For example, reportable fringe benefits are considered when determining eligibility for certain tax offsets, the Medicare levy surcharge, and other government benefits or obligations. It’s a balancing act; while promoting the use of environmentally friendly transportation, this reporting requirement ensures transparency and fairness in how fringe benefits are treated in the broader context of an individual’s tax affairs.

Novated lease arrangements

Novated lease arrangements are an increasingly popular way for employees to finance a new vehicle through their pre-tax income, offering potential tax benefits under certain conditions. Let’s delve deeper into what novated leases are and how they can be structured to take advantage of the Fringe Benefits Tax (FBT) exemption for electric vehicles.

What is a Novated Lease?

A novated lease is a financial arrangement that allows an employee to lease a vehicle through their employer. This agreement involves three parties: the employee, the employer, and the leasing company (financier). Essentially, the employee chooses the vehicle, and the employer agrees to take on the employee’s lease obligations. The payments are then made from the employee’s pre-tax income, which can result in tax savings and potentially lower the employee’s taxable income.

Under this arrangement, the employer makes lease payments on behalf of the employee directly to the financier from the employee’s pre-tax salary. This not only simplifies the payment process but can also offer benefits under the FBT rules, especially when an electric vehicle is leased, as it might qualify for FBT exemptions.

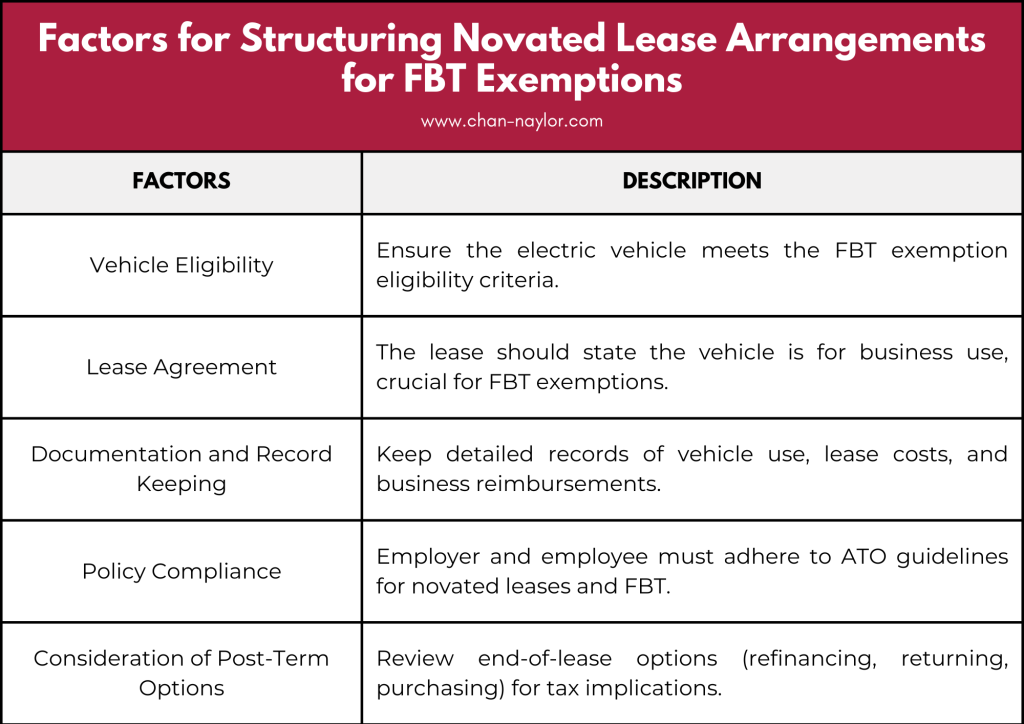

Structuring novated lease arrangements favorably

To ensure a novated lease arrangement qualifies for FBT exemptions with an electric vehicle, several key factors must be considered:

Vehicle eligibility

Ensure the electric vehicle meets the eligibility criteria for the FBT exemption.

Lease agreement

The terms of the novated lease agreement should explicitly state that the vehicle is primarily for business use. This distinction is crucial for qualifying for FBT exemptions, as personal use of the vehicle might still attract FBT.

Documentation and record keeping

Accurate and comprehensive documentation is vital. This includes keeping detailed records of the vehicle’s use, costs associated with the lease, and any reimbursements for business use. Such documentation supports the claim for FBT exemption and aids in the calculation of any potential fringe benefits.

Policy compliance

Both the employer and employee must understand their roles and responsibilities under the lease agreement. It’s essential to ensure that all parties comply with the ATO’s guidelines for novated leases and FBT exemptions. This might involve regular reviews of the agreement to align with current tax laws and FBT exemption criteria.

Consideration of post-term options

Consider the end-of-lease options carefully. Employees typically have the option to refinance the residual value on the lease, return the vehicle, or purchase it outright. How these options are handled can also affect the overall tax implications of the novated lease.

Next Step

Seek expert advice to ensure you’re making informed decisions that align with current legislation and maximise your benefits. Here at Chan & Naylor, we specialise in helping businesses and individuals navigate the intricacies of tax, including FBT exemptions for electric vehicles. Our team of experienced tax professionals can assist you in minimising tax liabilities while ensuring compliance with all ATO regulations. From structuring novated lease arrangements favorably to accurately calculating and reporting fringe benefits, we’re here to guide you every step of the way.

About Chan & Naylor

Since 1990, Chan & Naylor has partnered with business owners in managing their taxes and building a tax-effective wealth. Choosing Chan & Naylor means you’re not just selecting a service provider; you’re gaining a partner aligned with your financial goals. You’ll have access to a dedicated client manager supported by a team of accountants that specialises in property tax and investments.

Disclaimer

This guide serves as general advice and may not account for the unique circumstances of individual readers. For personalised and strategic solutions tailored to your specific situation, we invite you to seek professional advice from Chan & Naylor. Our highly experienced team is dedicated to helping you navigate the complexities of Australian taxation, ensuring that your financial strategies align with the latest regulations. Contact us today to embark on a path of informed and customised tax planning for your property investments.