What is SMSF?

A Self-Managed Super Fund (SMSF) is a way for Australians to take more control of their retirement savings. Unlike traditional super funds, an SMSF allows its members to be trustees, making wider ranging decisions about investments and managing the fund in compliance with legal obligations. This autonomy provides benefits such as tailored investment strategies and potential tax advantages, making it a preferred option for those seeking more personalised control over their superannuation. It’s crucial, however, for members to understand the regulatory requirements and responsibilities involved in managing an SMSF to ensure compliance and maximise the fund’s potential benefits.

Benefits of growing your SMSF

Growing your SMSF can lead to significant benefits, including:

Personalised investment strategies

By actively managing your SMSF, you can closely align your superannuation with your personal preferences, thereby taking greater control of your retirement assets and strategies.

Tax advantages

Just like other types of super funds, SMSFs offer specific tax benefits, such as lower tax rates on investment income and capital gains, which can significantly enhance your retirement fund’s growth over time. Since you can tailor your SMSF’s investment strategy, you can also benefit from a more personalised tax outcome compared to a retail or industry super fund.

Investment flexibility

With an SMSF, you have more freedom to invest in a wider range of assets suited to your personal preferences and tailored investment strategy, e.g. direct property and unlisted investments.

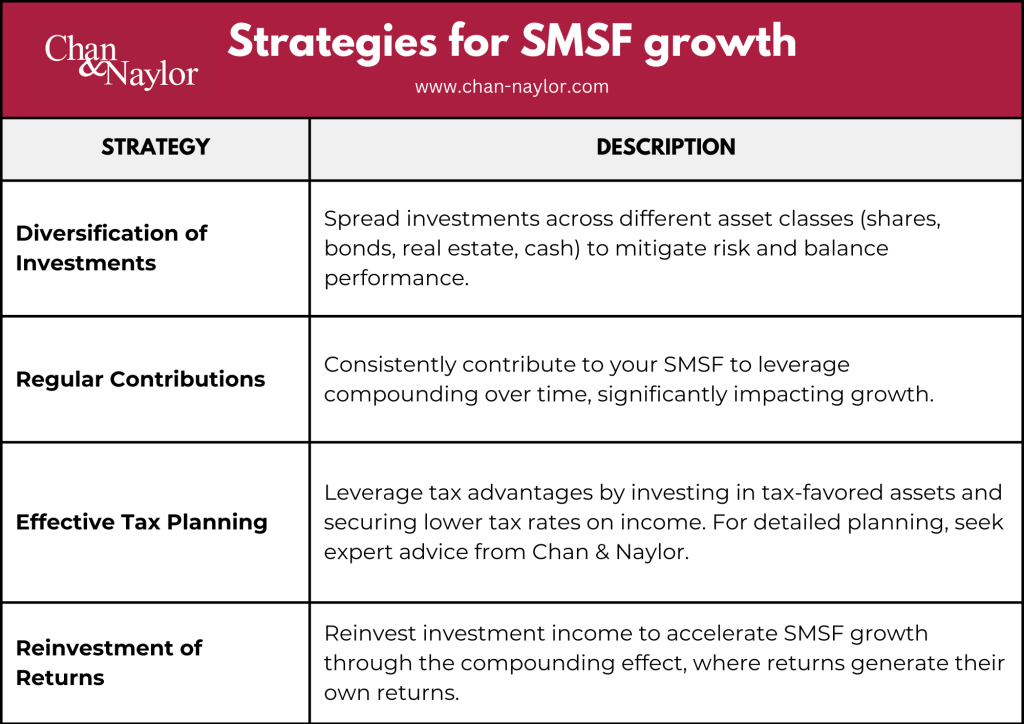

Key strategies for SMSF growth

To effectively grow your Self-Managed Super Fund (SMSF), implementing key strategies is crucial. Here’s an expanded look at each strategy:

Diversification of investments

This involves spreading your investments across different asset classes such as shares, bonds, real estate, and cash. Diversification helps mitigate risk because when one investment type underperforms, another might outperform, balancing the overall performance of your SMSF.

Regular contributions

Making consistent contributions to your SMSF can significantly impact its growth over time due to the power of compounding. Even small, regular additions can grow substantially over the long term.

Effective tax planning

Utilising the tax benefits available to SMSFs can greatly enhance growth. Strategies like investing in assets that offer capital gains tax discounts or ensuring income is taxed at the concessional superannuation rates can make a big difference in fund accumulation. For effective tax planning, it would be advantageous to seek advice from Chan & Naylor as we have decades of experience in SMSF as well as a team of highly skilled accountants that can assist you in managing your SMSF. Contact us today and let’s have a chat at how we can help you maximise your SMSF.

Reinvestment of returns

Instead of withdrawing all the investment income, reinvesting these returns can accelerate the growth of your SMSF. This strategy leverages the compounding effect, where your investment returns generate their own returns in the future.

Each of these strategies requires careful planning and consideration of the SMSF’s specific circumstances, financial goals, and risk tolerance. Chan & Naylor can provide custom strategies and insights, ensuring your fund’s strategy is both compliant and optimised for growth. Our expertise can be invaluable in navigating the intricacies of SMSF management and maximising your fund’s potential.

Seek professional advice

The dynamic landscape of superannuation and investment markets underscores the value of professional advice. Engaging with SMSF experts can provide you with tailored advice that considers your individual circumstances, financial goals, and risk tolerance. Professionals can help decipher complex regulations, offer strategic investment guidance, and ensure that your SMSF operates efficiently and complies with the law.

We’re here to help

Our team of experienced SMSF advisors is here to assist you. Whether you’re establishing a new fund, seeking strategies to maximise your investments, or need guidance on compliance and reporting, we have the expertise to support your journey.

Contact us

Reach out for personalised SMSF advice or to schedule a consultation. Let us help you achieve your retirement goals with confidence. Take the first step towards securing your financial future. Contact us today and embark on a path to a more informed and strategic SMSF management.

Rodel Claudio

Chan & Naylor

rodelc@chan-naylor.com.au

Authorised Representative

Alliance Wealth Pty Ltd ABN 93 161 647 007, Australian Financial Services Licence (AFSL) Number 449221. Part of the Centrepoint Alliance group

General Advice Only

Any advice is of a general nature only and has not been tailored to your personal circumstances. Please seek personal advice prior to acting on this information. Any advice on this website has been prepared without taking account of your objectives, financial situation or needs. Because of that, before acting on the advice, you should consider its appropriateness to you, having regard to your objectives, financial situation or needs.