PROPERTY INVESTORS ALERT

House Prices Falling as Interest Rates continue Jump so is the time right for property investors to invest?

According to the most recent data, home prices are falling because rising home loan interest rates are making it hard for banks to lend money and making it hard for people to pay back their home loans in ways that were unimaginable just six months ago.

Just six months ago, a typical family could borrow close to $1 million for a home loan. Now, they can only borrow around $750,000. This has caused sharp drops in home prices, and more drops are likely.

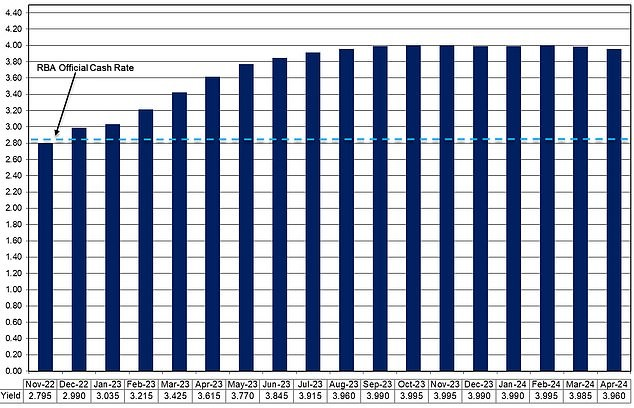

The Reserve Bank of Australia since May has raised the cash rate at eight consecutive meetings, with December taking it to a nine-year high of 3.10 per cent.

According to the data, the 3 percentage point increase in seven months is the most severe tightening of monetary policy since 1994. The RBA thinks that property prices will fall by 20% over the next two years from their highest point in 2022.

The Australian Prudential Regulation Authority mandated in November 2017 that lenders determine whether a borrower can afford a 300 basis point increase in variable mortgage rates.

Property analyst group CoreLogic research director Tim Lawless said borrowers were now dealing with a situation the banks themselves would not have foreseen just six months ago.

Some recent borrowers could be in uncharted waters in terms of their ability to pay back their loan with the latest rise in December.

A situation that has become more difficult due to rising living expenses that were not anticipated at the time the decision was made.

Early in May, when the RBA cash rate was at a record low of 0.1%, a Rate City new listings analysis showed that a couple with two children and a combined income of $150,000 could borrow up to $995,800.

After the most recent increase in December, the most this particular family could borrow would be around $750,000. Since the Reserve Bank began its cycle of interest rate increases, this represents a decrease of nearly 25 percent, or $245,800.

Rate City research director Sally Tindall said that rising interest rates were making it harder for borrowers to get a mortgage.

‘Many people’s home buying budgets have taken a hammering over the last seven months due to rising interest rates,’ she said.

The median house price in Sydney, Australia’s most home loan rates sensitive market, has this year fallen by 10.6 per cent to $1,257,625.

Even so, a borrower with a 20 per cent deposit would still be paying off a $1million mortgage.

The debt-to-income ratio of a borrower with a median annual salary of $92,030 would be 10.9.

This is considerably higher than the “six” threshold for mortgage stress set by the banking regulator, making it more likely that couples will be granted a loan.

At the beginning of November, the percentage of Sydney weekend property auctions where a home sold for more than the reserve price dropped from 76.6 percent a year earlier to just 61%.

Since May, borrowers with a $1 million mortgage have seen their monthly payments go from $3,843 to $5,393, an increase of $1,550.

Back in May, a borrower with an average $600,000 mortgage owed $2,306 in monthly mortgage repayments.

The latest December increase, however, will result in the same borrower’s monthly payments increasing by $91 to $3,236 from $3,145 beginning the following week.

As of December 6, the variable interest rate for a borrower with a 20% down payment at Commonwealth Bank went from 2.29 to 5.04 percent. This means that the average monthly mortgage payment has gone up by $930 in just six months.

Inflation in the year to September surged by 7.3 per cent – the fastest pace since 1990.

The Reserve Bank now thinks that inflation will stay above its goal of 2% to 3% until 2025.

This means that interest rates will go up even more. Westpac and ANZ both think that the cash rate will be 3.85% by May 2023.

The Commonwealth Bank, Australia’s biggest mortgage lender, predicted correctly the cash rate will become 3.1% in December. The cash rate will be 3.6% by March, according to Australia’s biggest business lender, NAB.

Note: A different comparison rate could result from different terms, fees, or other loan amounts.

The futures market is expecting a 3.85 PERCENT cash rate by June and a 4 per cent cash rate by September.

Mr Lawless said house prices were likely to keep falling as interest rates kept on rising.

“With the cost of debt going up, the outlook for home prices and real estate market activity remains negative,” he said.

“Even though the rate of property value decline has slowed in some cities over the past few months, we expect home prices to keep going down until interest rates reach a ceiling.”

Ms. Tindall said that APRA, the bank regulator, might have to change the mortgage stress threshold from 3 percentage points, which was set a year ago, back to 2.5 percentage points.

After a year, new buyers are finding it hard to pass this test, and many people who bought at or near the peak of the market are worried about how their budgets will hold up as interest rates go up,’ she said.

“APRA could decide to lower the stress test back to 2.5%, but it’s unlikely to make a decision quickly.”

‘The regulator will be looking for a clearer position of where the cash rate is likely to land before stepping in again.’

House prices fall in EVERY capital city

-

BRISBANE: Down 2.2 per cent to $817,684

-

SYDNEY: Down 1.5 per cent to $1,257,625

-

CANBERRA: Down 1.1 per cent to $990,851

-

HOBART: Down 1 per cent to $754,640

-

MELBOURNE: Down 0.9 per cent to $924,492

-

DARWIN: Down 0.9 per cent to $588,053

-

ADELAIDE: Down 0.5 per cent to $706,154

-

PERTH: Down 0.2 per cent to $584,232

Source: CoreLogic data on median house prices in October 2022

Shane Oliver, the chief economist at AMP Capital, said that if the Reserve Bank kept raising rates, it could hurt the stability of the financial system by making stressed borrowers owe more on their home than it was worth. This is called negative equity.

He said, “There is more and more evidence that the RBA’s interest rate hikes are working. All of the housing indicators are very weak, and falling property prices will hurt demand and raise risks to financial stability.”

Dr Oliver is forecasting a possible February increase to 3.35 per cent.

What a 0.25 percentage point interest rate rise in December means

-

$500,000: Up $76 to $2,697 from $2,621

-

$600,000: Up $91 to $3,236 from $3,145

-

$700,000: Up $106 to $3,775 from $3,669

-

$800,000: Up $122 to $4,315 from $4,193

-

$900,000: Up $137 to $4,854 from $4,717

-

$1,000,000: Up $152 to $5,393 from $5,241

Due to the Reserve Bank of Australia cash rate going up from 2.85% to 3.10%, the monthly payment on a variable loan from Commonwealth Bank goes up from 4.79 to 5.04%.

So, what does this all mean for Property Investors and first home buyers?

Over the coming 12 months based on the data and in this current economic climate, we should start seeing opportunities for cashed-up property investors and home buyers to acquire at discounted prices in the marketplace.

——————————————

David Naylor | Chan & Naylor