Key Points

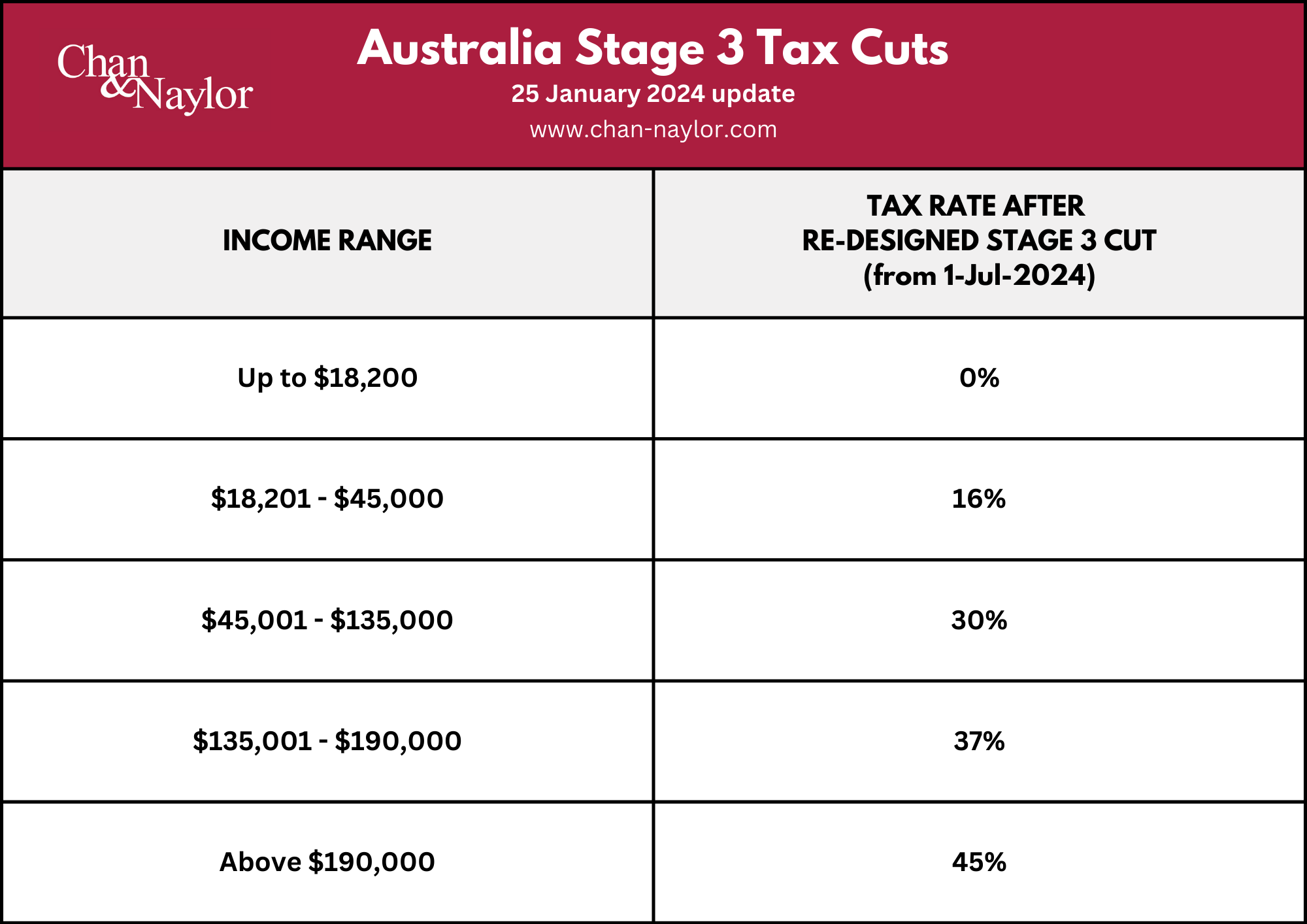

- Prime Minister Anthony Albanese announced significant changes to Australia’s Stage 3 tax cuts on 25 January 2024.

- The lowest tax rate is reduced from 19% to 16% for incomes under $45,000.

- Adjustments made to tax brackets to provide relief for middle-income earners.

- The new rates will start to apply on 01 July 2024.

- The changes are budget and inflation neutral, as advised by the Treasury.

- Contact Chan & Naylor for expert tax advice on these new reforms.

Prime Minister Anthony Albanese made a pivotal announcement on 25 January 2024, regarding the Stage 3 tax cuts. These changes, set to take effect from 01 July 2024. This development is crucial for all taxpayers, as it impacts a broad spectrum of income earners across the nation. Here’s a comprehensive overview of the latest changes:

Reduction of the Lowest Tax Rate

The lowest income tax rate has been cut from 19 cents in the dollar to 16 cents. This reduction benefits taxpayers earning less than $45,000, ensuring they receive a tax cut. Consequently, all Australians will enjoy lower taxes on the first $45,000 of their income.

Adjustments to Tax Brackets

The 32.5% tax bracket is now reduced to 30%, applicable to incomes up to $135,000. The 37% tax rate will continue, now applied to incomes ranging from $135,000 to $190,000. The threshold for the top tax rate of 45% is raised from $180,000 to $190,000.

*Note: Tax rates mentioned above did not include the 2% Medicare Levy

Impact on Various Income Levels

For example, an early educator, aged care worker, or cleaner earning $50,000 will benefit from a tax cut exceeding $900 annually. These changes aim to provide more significant tax relief to middle-income Australians, aligning with the government’s focus on easing cost of living pressures.

Budget and Inflation Implications

The Treasury has advised that these changes will be neutral regarding the budget and inflation. This means they are not expected to contribute to inflationary pressures. The adjustments are also anticipated to support labor supply without adversely affecting the government’s inflation forecasts.

Political Context

These revisions to Stage 3 mark a departure from the initial plan set by the previous government, which aimed to abolish the 37% tax bracket and apply a flat 30% rate to incomes between $45,000 and $200,000.The current changes are seen as a response to the evolving economic conditions and the challenges facing Australians, particularly in terms of cost of living.

Summary

The Stage 3 tax cuts have been tailored to provide more targeted relief to lower and middle-income earners while maintaining a more progressive tax structure. The adjustments include an increase in the top tax rate threshold, albeit less than initially planned, and a decrease in the lowest tax rate to benefit those earning below $45,000.

Keep Updated

We encourage our readers to stay tuned for more updates on these tax changes. It’s important to understand how these adjustments may impact your financial situation. For personalised advice and to navigate these new tax changes effectively, we recommend seeking professional guidance from Chan & Naylor. Our team of expert accountants and advisors are well-equipped to provide you with the insights and strategies you need to make the most of these tax reforms.

We’re here to help

Contact Chan & Naylor today for expert tax advice and stay ahead in managing your finances under the new tax regime.