What are Council Rates?

Council Rates in Australia are local taxes levied by municipal or local governments on property owners. These rates are typically based on the land value of the property. The main purpose of council rates is to fund local services and infrastructure such as public schools, road maintenance, local police and fire departments, and public works like parks and libraries.

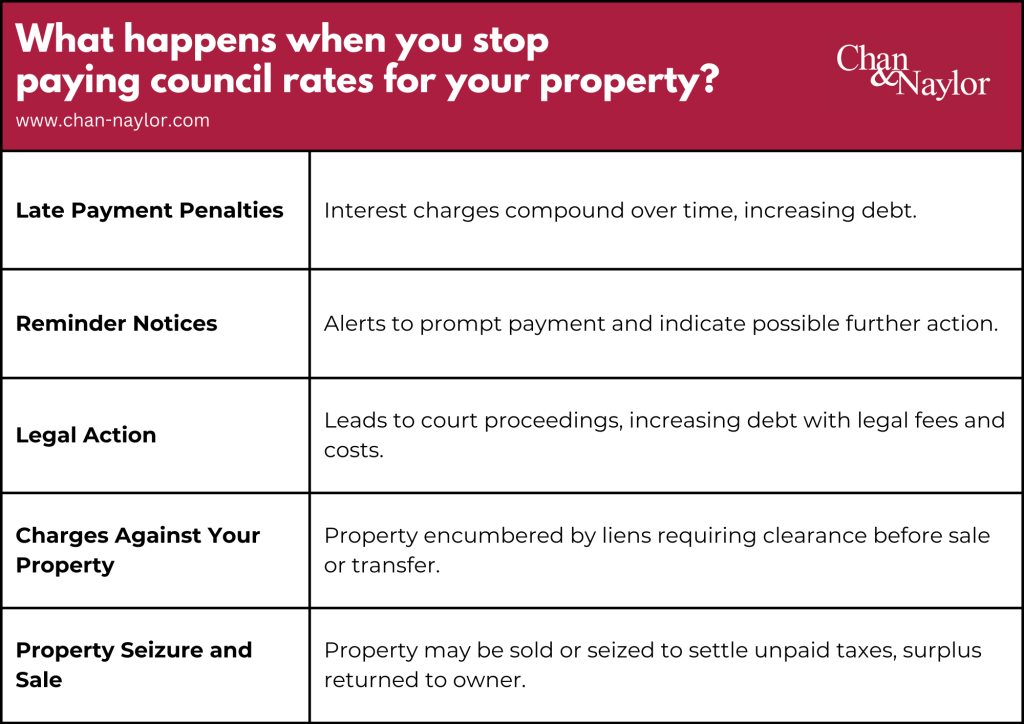

What happens when you stop paying council rates?

Late payment penalties

When council rates are overdue, the local council imposes late payment penalties. These penalties often take the form of interest charges, which compound over time, adding a significant burden to the original amount. The longer the delay in payment, the larger the debt grows, making it more challenging to clear the dues.

Reminder notices

Councils send out reminder notices to property owners who have overdue taxes. These reminders serve as an alert to address the unpaid rates promptly. Ignoring these notices not only increases financial liability due to accumulating penalties but also signals to the council that further action may be necessary.

Legal action

If reminders are ignored and rates remain unpaid, councils can initiate legal action. This process involves court proceedings, which can be both stressful and expensive. Legal action can lead to additional costs in the form of legal fees and court costs, adding to the financial burden.

Charges against your property

In some cases, councils can place a charge or lien against the property for unpaid rates. This charge must be cleared before the property can be sold or transferred. It acts as a legal claim on the property, ensuring that the debt is settled before any change in ownership.

Property seizure and sale

As a last resort, if other methods of recovery fail, the council may seize or sell the property to recover the unpaid rates. This is a drastic measure and usually occurs after a significant period of non-payment. The sale of the property is used to settle the debt, with any surplus funds returned to the owner.

How long can you get away with not paying council rates in Australia?

The length of time you can go without paying council rates for your property before facing serious consequences, such as foreclosure or the sale of your property, varies significantly depending on where you live. Generally, if council rates are not paid, the amount owed becomes a lien on the property. This means that the local government or taxing authority has a legal claim against your property for the unpaid amount. If the rates remain unpaid, the taxing authority may eventually sell the home to recover the overdue rates, either through a tax foreclosure process or by selling the property outright. In some jurisdictions, the property is sold at a tax sale to the highest bidder, while in others, the tax lien itself is sold, and the purchaser may eventually acquire the title to the property if the taxes are not paid within a specified redemption period.

What can you do?

It’s important to address unpaid council rates as soon as possible to avoid these severe consequences. Homeowners might have options like objecting to the assessment, seeking abatement, deferral, or a compromise, or negotiating the tax bill to manage or reduce their tax liability. Additionally, some States offer exemptions, deferrals, or reductions in tax liability for eligible taxpayers based on age, disability, income level, or personal status. If your property is at risk of a tax sale, you might also have the option to redeem the property by paying off the full amount owed, plus any additional costs and interest, within a certain period after the sale.

Because the specifics can vary so widely based on local laws and regulations, it’s crucial to understand the rules in your jurisdiction and to seek professional advice if you’re facing difficulties with unpaid property taxes.

Is it a crime to not pay your council rates in Australia?

The most severe consequence of not paying property taxes can include the council selling the property to recover unpaid taxes. However, these actions are civil rather than criminal proceedings. It means that while failing to pay property taxes can lead to legal actions and financial penalties, it does not constitute a crime that would, for example, result in imprisonment.

Property owners facing difficulty in paying their property taxes should contact their local council and property accountant to discuss possible arrangements, such as payment plans or hardship considerations, to avoid escalation of the situation.

Proactive measures

Despite these severe consequences, councils are often willing to work with property owners facing financial difficulties. They may offer payment plans to spread the tax payments over a longer period, making them more manageable. Some councils also have provisions for financial hardship, where they can offer temporary relief or adjusted payment terms. Keeping open lines of communication with the council and being proactive in addressing tax obligations are key to avoiding serious repercussions.

Chan & Naylor: your partner in property taxation

Dealing with unpaid property taxes can be a daunting prospect, but you don’t have to face it alone. At Chan & Naylor, our team of property tax accountants is here to guide you through these challenges. We can help you navigate the complexities of your situation, offering tailored solutions to resolve your tax issues and safeguard your property investment. Don’t let the fear of unpaid property taxes overwhelm you. Reach out to Chan & Naylor for peace of mind and expert assistance in securing your financial future.

About Chan & Naylor

Founded in 1990, we have partnered with thousands of property owners all over Australia. Choosing Chan & Naylor means you’re not just selecting a service provider; you’re gaining a partner aligned with your financial goals. You’ll have access to a dedicated client manager supported by a team of accountants that specialises in property tax and investments.

Disclaimer

While this guide offers a general overview, individual circumstances vary. For personalised and strategic tax solutions, especially concerning property investments, consulting with Chan & Naylor’s investment accountants is advisable. Our expertise in Australian taxation will ensure your strategies comply with current regulations, offering peace of mind and a solid foundation for your financial and investment planning. Contact us to explore custom tax planning tailored to your property investment needs.